We leverage our unique position along with our digital process to offer some of the most aggressive rates on the market. Our rates are are live and available 24/7 on our site with no strings attached.

Mortgages for the Savvy Borrower

Loan Professors is a direct lender with additional access to the nation’s top wholesale lenders.

(Some might say best of both worlds)

100

TOP LENDERS IN THE US

25

DAYS AVERAGE CLOSING

10

MINUTES TO APPLY

Today's Mortgage Rates

RATES AND PRICING VARY. READ DISCLAIMER.

- Subject to underwriting guidelines and applicant’s credit profile.

- Listed rates are for a 30-Year Fixed Mortgage, Primary Residence, First Lien, Los Angeles County, and the assumptions listed below.

- The actual interest rate, APR and payment may vary based on the specific terms of the loan selected, verification of information, your credit history, the location and type of property, and other factors as determined by Lender.

- Rate lock period is 30 days.

- An escrow account may be required.

- Loan options and/or lending services may not be available in all states.

- Borrowers making a down payment of less than 20% may require mortgage insurance, which could increase the monthly payment and APR.

- Closing costs displayed here are estimates and can vary based on numerous factors.

- Contact Loan Professors for more information and up to date rates.

Loan scenario assumptions:

- 30-Year Fixed – Conventional, 20% down, $500,000 purchase price, 740 minimum credit score.

- VA 30-Year Fixed – 0% down, $500,000 purchase price. 740 minimum credit score.

- FHA 30-Year Fixed – 3.5% down, $500,000 purchase price. 700 minimum credit score.

- Jumbo 30-Year Fixed – 30% down, $1,600,000 purchase price, 760 minimum credit score.

Backed By

Backed By

How it Works

We’ll walk you through the process so that you’re educated on your options and armed with a pre-approved loan right when you need it most.

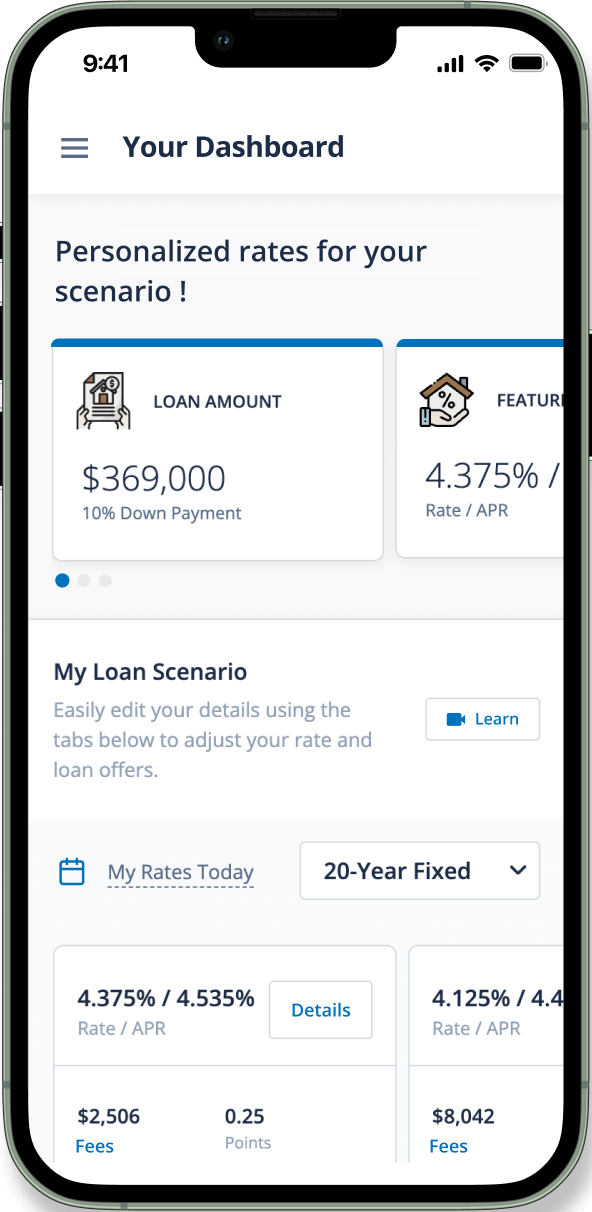

CHOOSE YOUR RATE

Shop and compare rates 24/7 with no strings attached.

Apply in minutes

Apply online from anywhere, using any device, in minutes.

Get Approved

Once a program is selected, we’ll finalize the loan application and work on your loan approval or pre-approval.

Close Your Loan

With approval in hand, you’ll be able to close on your property in as little as 21 days.

Savvy Clients = Happy Clients

Chat With One of Our

Loan Specialists Today.

We’re available Monday to Friday to answer your questions!